AskKtpAud AskThkSec 15032022 1 Lodgement with SSM a circulate to members within 6 months from financial year end S258 1a of Companies Act CA 2016. It is 5 million people.

Pdf The Provision Of Non Audit Services Audit Fees And Auditor Independence

From 1st January 2016 until today Company A has not conducted any business activity.

. It has revenue includes revenue receivable during the year not exceeding RM100000 during the current financial year and in the immediate past two 2 financial years. The Companies Commission of Malaysia has issued Practice Directive No. August 14 2017 by Conventus Law.

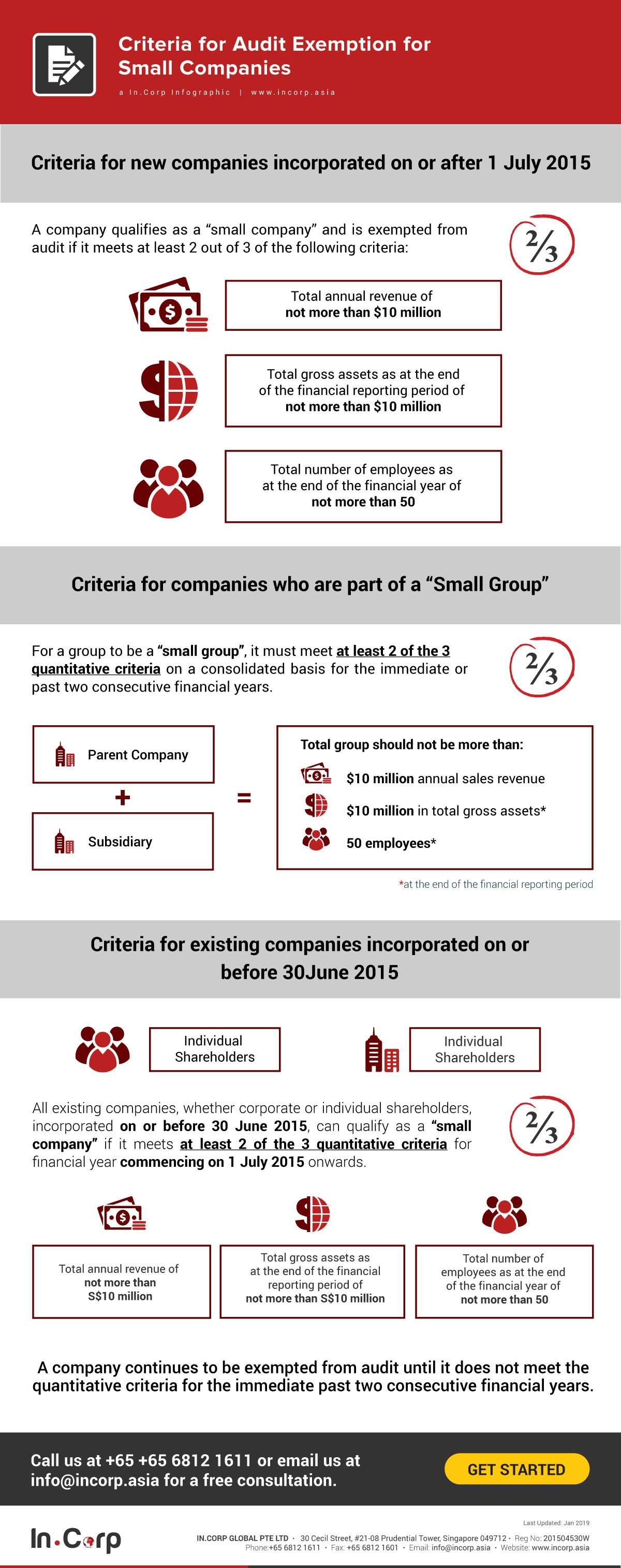

On 4 August 2017 the Companies Commission of Malaysia CCM issued its Practice Directive No. A threshold-qualified company is qualified for an audit exemption if it fulfills the following criteria- It has revenue not exceeding RM100000 during the current financial year and in the immediate past two 2 financial years. Companies that satisfy the criteria set forth shall not be required to appoint an approved auditor to prepare and audit their financial statements before lodging.

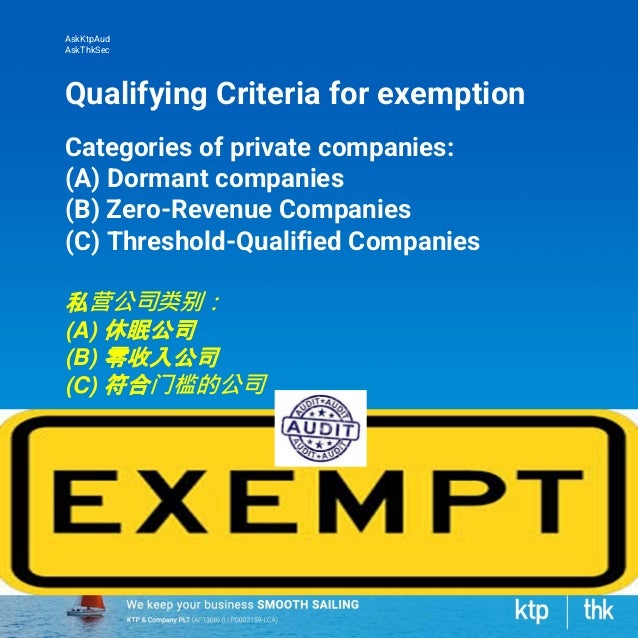

Audit Exemption for Private Companies. If your company meets 2 of the following requirements it may qualify for an audit exemption. A company is dormant in a financial year if the company does not carry on business and there is no accounting transaction occurred.

A dormant company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is qualified for audit exemption if it has been dormant from the time of its incorporation. The company is dormant this means the business has no accounting transactions occurring and its operations have. The criteria for audit exemption for certain private companies are.

What Does Exemption From Audit Mean. Report to the members of the company whether the financial statements which we have audited give a true and fair view of the state of affairs and whether all book of account have been properly kept in accordance with the provisions of the Act. Dormant companies A dormant company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is.

Assuming that the financial year-end is on 31 December every year. 32017 Company that elects to be exempted from audit shall lodge its unaudited financial statements to Suruhanjaya Syarikat Malaysia SSM together with certificate in compliance with sections 258 and 259 of the Companies Act 2016. A it has been dormant from the time of its formation.

The purpose of this paper is to examine the factors that influence the acceptance on audit exemption among the SMEs in Malaysia. On 4 August 2017 the Companies Commission of Malaysia SSM brought into action audit exemption for certain categories of private companies. Written by Gunalan Appalasamy CA M It was proposed that Dormant Companies.

A turnover of less than 6 per year. In line with the qualifying criteria for audit exemption stated accordance to Practice Directive No. All companies incorporated in Malaysia must have their accounts audited by a Ministry of Finance approved auditor as mandated by the Companies Act of 2016.

On 4 August 2017 the Companies Commission of Malaysia SSM brought into effect audit exemption for certain categories of private companies. A threshold-qualified company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is qualified for an audit exemption if. 我的 Sdn Bhd Account 要怎样不需审计 How can I be exempt from audit.

A dormant company is a private entity as defined by the Malaysian Accounting Standards Board MASB and the company is qualified for audit exemption if it has been dormant from the time of its incorporation. A turnover of less than 6 per year. QUALIFY FOR AUDIT EXEMPTION Note 6 QUALIFY FOR AUDIT EXEMPTION Note 6 Criteria for Exemption Additional Requirement NO NO NO NO NO NO YES YES YES YES YES YES NOTE 1 Para.

This article is based on Proposed Practice Directive 12017 on Audit Exemption issued by CCMSSM on 8 November 2016. Company A was incorporated on 1st January 2016. An auditor shall not be required to be appointed in order to prepare and audit financial statements if.

How do I file an exemption for an audit. 32017 on the Qualifying Criteria for Audit Exemption for Certain Categories of Private Companies Practice Directive. Or b it has been dormant for three consecutive financial years Small Companies.

Company A may apply for audit exemption. The authors also found that the primary contributors to audit. It is 5 million.

Or it is dormant throughout the current financial year and in the immediate preceding financial year. Company B was incorporated on 1st January 2016. 47 47A Jalan Jati 2 Taman Nusa Bestari Jaya 79150 Iskandar Puteri Johor.

The Companies Act 2016 CA 2016 requires every private. Or it is dormant throughout the current financial year and in the immediate preceding financial year. A dormant company Malaysia shall be exempt from audit requirements if.

What are the limits for exemption in Malaysia. 2008a examined the auditors perceptions on eliminating mandatory annual audits and found that in general auditors in Malaysia are opposed to the audit exemption regulation. On August 4 2017 the Companies Commission of Malaysia CCM has brought into force audit exemption for certain categories of private companies.

32017 to set out the qualifying criteria for private companies to be exempted from appointing an auditor for a financial year. AskKtpAud AskThkSec 15032022 2. Audit Exemption Malaysia - Part 2 1.

What is the threshold for company audit exemption. If your company meets 2 of the following requirements it may qualify for an audit exemption. To further reduce the cost of doing business the Companies Commission of Malaysia has announced that dormant zero-revenue and threshold-qualified private companies are eligible to elect for audit exemption.

What Are The Criteria For Audit Exemption For Small Company Infographics

Qualifying Criteria For Audit Exemption For Malaysia Private Limited Companies

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Pdf Reasons Against Audit Exemption Among Sme Companies In Malaysia Semantic Scholar

Audit Exemption For Malaysian Smes Does Ownership Matter Asian Journal Of Accounting Perspectives

How To Qualify For Audit Exemption In Malaysia With Example

English Audit Exemption Ssm Pd 3 2017 Disclosure Of Annual Return

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Audit Exemption In Malaysia How To Qualify For It

Pdf Audit Exemption For Small And Medium Enterprise Perceptions Of Malaysian Auditors

Audit Exemption For Private Companies Venture Haven Top Malaysia Accounting Firm

English Audit Exemption Ssm Pd 3 2017 Disclosure Of Annual Return

How To Qualify For Audit Exemption In Malaysia With Example

Audit Exemption In Malaysia Am I Eligible Quadrant Biz Solutions

Private Exempt Company Lucarkc